Food and beverage industries, as well as tobacco industries, have always been in the focus of policymakers and economic planners because they are directly related to the level of well-being and satisfaction of citizens. Netherlands is one of the countries that has been able to become one of the main suppliers of food and beverages as well as processed tobacco products in Europe during the last decades. However, from 2009 until now, the process of changing the value of food and beverage industry products in Netherlands has not been very favorable, and the value of tobacco industry products in this country has also decreased significantly.

Great progress

Food, drink and medicines fulfill a large part of basic human needs. Therefore, development and strengthening of food supply chains has always been one of the axes of macro-planning among the policy makers of societies. The rapid growth of the population, technological advancement, and as a result, passing from traditional structures and entering into industrial and modernized frameworks, and as a result, have caused a change in lifestyle and development of urbanization. At the same time, they have changed consumption patterns, and over time, they have provided grounds for formation of food and beverage industry and tobacco industry. Food and beverage industry includes all the processes of converting raw food into consumer food products and does not include production of raw food that is dedicated to agricultural sector. Tobacco industry also refers to the set of activities that are focused on processing and production of tobacco products such as cigarettes.

At present, food and beverage industry and tobacco industry (due to the necessity of providing food and welfare security and taking advantage of opportunities to create jobs and added value) have been significantly developed in many countries, among which Netherlands can be mentioned. This country has relatively modern and powerful food, beverage and tobacco industries. According to the latest estimates, food and beverage industry in Netherlands includes activities of more than 8 thousand companies, and by creating jobs for about 152 thousand people and annual net sales of $98 billion, it constitutes approximately 15-20% of the country’s economy.

Advantage of Rotterdam

Before the 20th century, food conditions in Netherlands were not very favorable, to the extent that most people met a significant part of their food needs by consuming potatoes. Meat was so expensive that only the wealthy could afford it. Food was considered only as a source of energy for labor. However, from the second half of the 20th century onwards, following the government’s Dovish policies in Netherlands, the average income of workers (as the largest consumer group) increased in this country and as a result they too could have a more varied diet because the rise in real wage levels quickly changed the living standards of the lower classes in Netherlands for the better. At that time, most Dutch citizens saw food as something more than just a source of energy, which caused the market for processed foods (as the most important principle in development of food and beverage industry) to expand significantly.

However, the Second World War caused Netherlands to suffer from famine (agricultural food products) on the one hand, and on the other hand, the wages of workers were kept at a relatively low level, which resulted in a negative shock to Netherlands food and beverage industry. It should be mentioned that in the years after the end of World War II, food supply chains in Netherlands experienced fundamental changes. The first supermarkets (which played a very important role in stabilizing the conditions of processed food and beverage markets) were opened in this country, and the variety of food products also increased greatly. Currently, food retail sector in Netherlands is relatively consolidated so that only 5 brands of “Albert Heijn”, “Jumbo”, “Aldi”, “Lidl” and “Dirk” account for about 80% of the share of food retail market in this country.

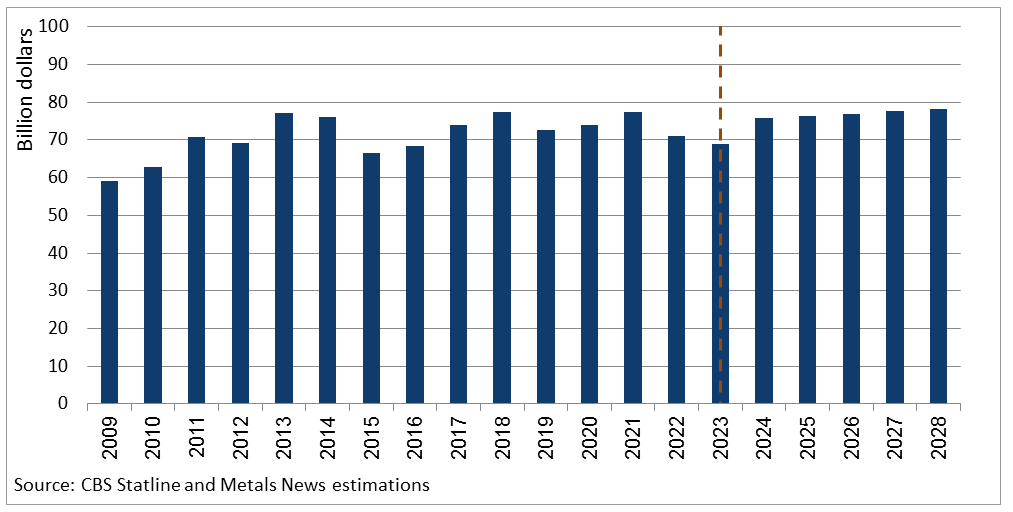

Chart 1. Production value of food industry in Netherlands

Chart 1. Production value of food industry in Netherlands

Food and beverage industry in Netherlands, despite the fact that the country’s agricultural sector is fully developed and plays a prominent role in the global food supply chain, relies mainly on the import of food raw materials (especially from the United States of America). In fact, Netherlands is one of the first export destinations for agricultural products from other countries outside of Europe, due to its Rotterdam port and Schiphol airport, as well as extensive and modern road and railroad transport infrastructure which re-exports part of imported agricultural raw materials after processing at the European Union level.

Development in recent years

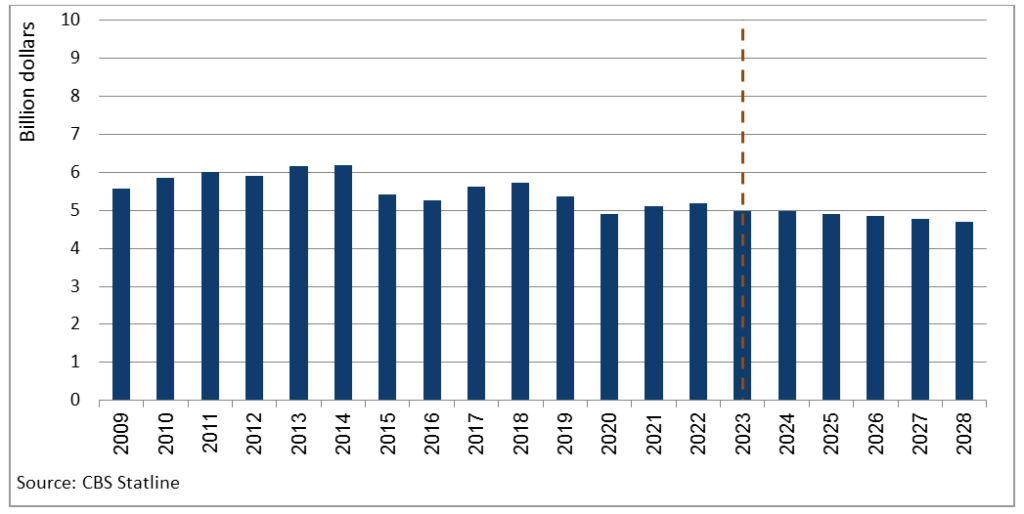

Value of food and beverage industry production in Netherlands in 2009 was approximately $64.5 billion (of which $59 billion were allocated to the value of food industry production and $5.5 billion to the value of beverage industry production). Production value of processed food and beverages in Netherlands reached an all-time high of $83 billion between 2013 and 2018. The outbreak of Corona crisis affected a large part of the companies active in the food and beverage supply chain in Netherlands. In the second half of 2021, Netherlands food and beverage industry faced an increase in cost of supplying agricultural raw materials, packaging materials, energy and transportation. In this regard, statistics show that the price of some raw materials increased by 40%, price of energy by 85%, and packaging materials such as paper and plastic by 6% and 12%, respectively, compared to before Corona crisis. Part of the increase in production costs in Netherlands food and beverage industry during the Corona crisis was transferred to end consumer in the form of an increase in product prices. Therefore, value of food and beverage products in this country in 2020 and 2021 experienced a growth of 1% and 5.6%, respectively, compared to 2019. However, increase in costs led to a decrease in the profit margin and added value of food and beverage industry in Netherlands. It should be noted that in 2020 and 2021, the amount of bankruptcies in Netherlands food and beverage industry (under the influence of continuous bank support and comprehensive fiscal stimulus) was much lower than expected. In 2022 and 2023, under the negative shock of Russia-Ukrain war, food and beverage value chains among producers and retailers were under severe pressure, because in conditions of a significant increase in energy prices, each group of food suppliers in Netherlands sought to maintain their profit margins. Reports presented indicate that during Russia-Ukrain war, companies active in the field of food supply in Netherlands have been somewhat successful in maintaining their profit margins (compared to the long-term average). However, the value of food and beverage industry production in this country faced a 10.2% drop.

Chart 2. Production value of beverage and tobacco industries in Netherlands

Chart 2. Production value of beverage and tobacco industries in Netherlands

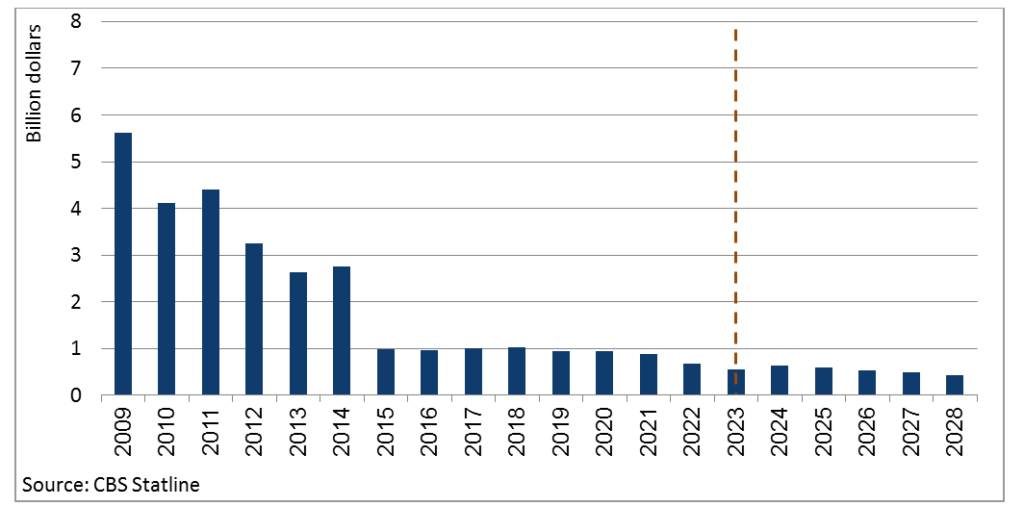

Formation of the tobacco industry in Netherlands is rooted in the country’s role in providing tobacco needed by other European countries and Russia, as well as the expansion of tobacco consumption culture and extremely high profitability of its trade in the 17th century. Reports presented indicate that in the past, tobacco industry and trade in Netherlands had a significant boom and this country was one of the largest suppliers of processed tobacco in Europe. However, statistics show that tobacco industry has gone through a relatively rapid downward trend in recent years. In 2023, production value of the tobacco industry decreased to about $542 million; a figure that is almost one-tenth of value of tobacco production in Netherlands in 2009.

Investigating consumption of metals

Food and beverage industries and to some extent tobacco industries are one of the metal consumption markets, especially steel, tin and aluminum. Processing of raw food is done according to specific standards. In this regard, one of the most important issues is packaging of food and beverages. Packaging in food and beverage industries is not only one of the most important processing steps in these industries, but nowadays it has become one of the most determining factors of competitiveness among producers.

Chart 3. Production value of tobacco industries in Netherlands

Chart 3. Production value of tobacco industries in Netherlands

All kinds of tinplate steels and aluminum sheets and foils are widely used in process of packaging food and beverage products. Tolerance of acidic and alkaline environments and high resistance to corrosion are the main characteristics of the mentioned metals, which make them attractive for use in food and beverage industries. In addition, impermeability of metal packaging to light minimizes the possibility of bacterial growth in packaged food products, which in turn has increased the need to develop the use of metals in packaging process of food and beverage products. It should be noted that steel and aluminum metals, in addition to being directly used in food and beverage industries, it is used in development of capacity of food and beverage processing factories (either from the construction site of the building or from manufacturing site of machinery and equipment necessary for processing).

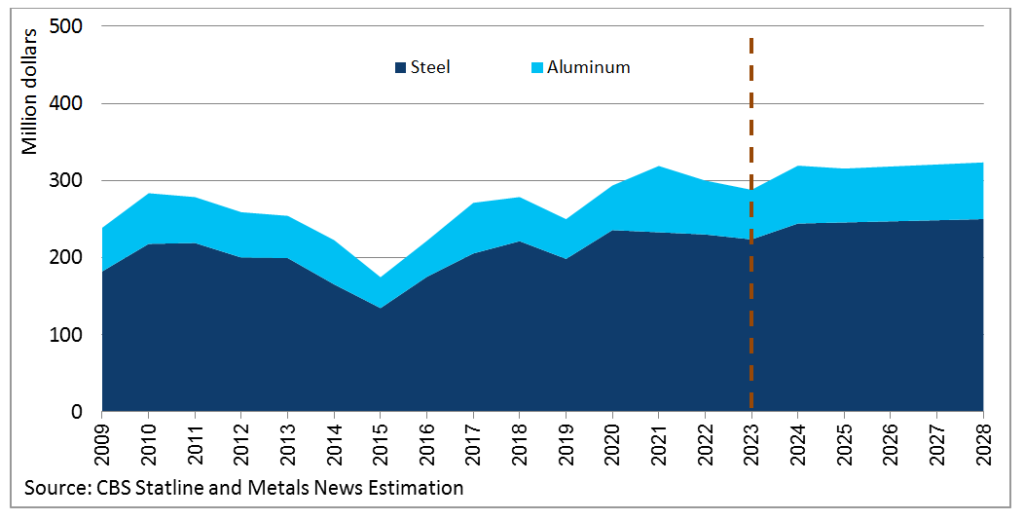

Chart 4. The trend of recent years of consumption value metals in Netherlands food industry

Chart 4. The trend of recent years of consumption value metals in Netherlands food industry

Trends in the consumption value of steel and aluminum in Netherlands food industry are depicted in chart 3. As can be seen, in 2009, consumption value of steel and aluminum in Netherlands food industry was about $182 million and $56.6 million, respectively. Along with boom in food industry production in Netherlands until the end of 2018, consumption value of steel and aluminum in this sector experienced an average annual growth of 2.4% and 0.1%, respectively, and reached $221.2 million and $57.2 million. However, studies show that the intensity of steel consumption in Netherlands food industry has decreased significantly in recent years and in the period from 2018 to 2023, consumption value of steel in production of food industry in this country experienced an average annual growth of 0.2%. On the other hand, the average growth of consumption value of aluminum in the process of food, beverage and tobacco production in Netherlands has reached about 2.5%. Currently, consumption value of steel and aluminum in Netherlands food industry is estimated at $223.5 million and $64.3 million, respectively. Forecastes indicate that by the end of 2028, consumption value of steel and aluminum in food production will increase to $249.8 million and $73.5 million.

1 comment

This article got me thinking about comparable scenarios in other countries.

It would be enlightening to see a comparative analysis of how

different localities are addressing this issue.