China’s maritime and port infrastructure has become a key pillar of its economic and trade development strategy over the past two decades. Relying on its privileged geographical location and extensive coastline, China has built a network of ports that are now among the most capacious and modern terminals in the world. Massive investments in this area, which accelerated since the early 2000s, paved the way for China’s ports to become pivotal centers of international trade and key links in the global supply chain. This development has not only led to the expansion of loading capacity and specialization of terminals, but also, by utilizing new technologies such as digitalization, intelligent systems and multimodal connectivity, has improved the efficiency and competitiveness of China’s ports. The result of this approach has been to reinforced China’s presence as one of the world’s leading maritime powers and to create an organic link between ports, the national transportation network and international markets.

The endless road

China’s maritime and port infrastructure is the backbone of its strategy in the global economy and international trade network. With more than 18 thousand kilometers of coastline and access to the South China Sea, the Yellow Sea, and the Western Pacific Ocean, China holds a geoeconomic position that has made the development of ports a national priority. The country’s major ports, such as Shanghai, Ningbo-Zhoushan, Shenzhen, and Guangzhou, are among the busiest cargo ports not only nationally but also globally, handling a huge volume of container and dry bulk trade.

The expansion of China’s port capacity is the result of a combination of targeted central government policies, large-scale investments, and the use of new technologies in logistics and maritime transport. Since the 1990s, the Chinese government has pursued port development as a key part of its “Open Door” strategy and later as part of major initiatives such as the “Belt and Road” initiative. This approach has transformed the country’s ports into international hubs for the exchange of goods, energy, and raw materials, significantly enhancing China’s role in the global value chain.

A distinctive feature of this infrastructure is the diversity and specialization of terminals. From container terminals with a capacity of several tens of millions of TEUs to specialized terminals for crude oil, liquefied natural gas (LNG), iron ore, and coal, China’s port network has been able to meet the complex needs of a huge industrial economy. This level of development not only affects energy and raw material security, but also increases China’s ability to export industrial and consumer products, and has become a determining factor in the world’s trade balance.

Overall, China’s maritime and port infrastructure not only plays a supporting role in trade, but is also a strategic part of the country’s economic power. They have provided a platform for the integration of the domestic market, the connection of coastal and inland regions, and the strengthening of China’s geoeconomic position on the global stage.

The path of investment

China’s port infrastructure development reflects the country’s grand strategy to become a global maritime and trade power. Since the early 2000s, massive investments in expanding port capacity and modernizing terminals have made China’s ports a major player in the global supply chain. Investment in this sector, which was $3.3 billion in 2003, has grown steadily to $19.3 billion by 2023 and is expected to reach around $20.3 billion by 2030, based on current trends. This investment momentum has been fueled by national initiatives such as the Five-Year Transport Development Plan and policies related to the Belt and Road Initiative, making the country’s port network one of the most efficient and high-capacity in the world.

In terms of operational capacity, China’s major ports have experienced impressive growth. Shanghai, in particular, has been the world’s busiest container port since 2010, a testament to the success of this strategy. Ningbo-Zhoushan, with its extensive development of dry bulk and container terminals, is now one of the main entry points for iron ore, coal and crude oil into China. Alongside these two, the ports of Shenzhen, Guangzhou and Tianjin serve as regional logistics hubs, enabling the distribution of goods across the country and beyond.

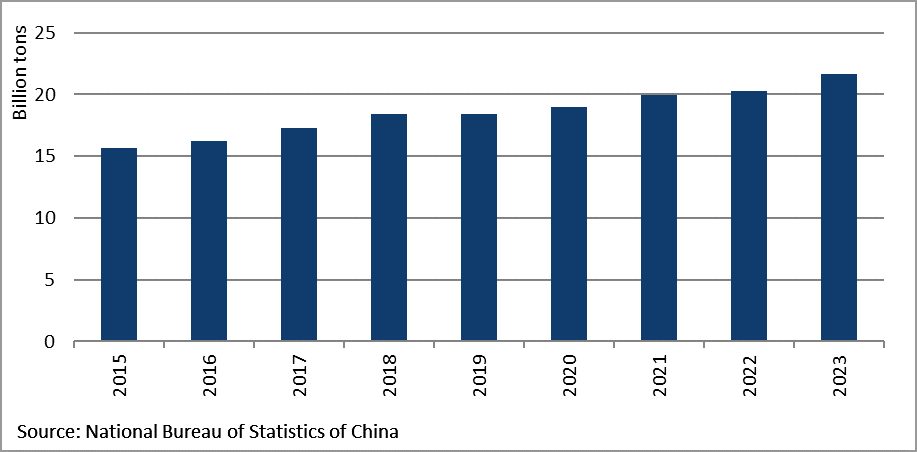

Chart 1. Cargo handled at China’s major ports in recent years

Chart 1. Cargo handled at China’s major ports in recent years

The development of this network is not limited to increasing loading capacity, but has also been accompanied by the improvement of management technologies and the digitalization of processes. The use of intelligent maritime traffic control systems, automated cranes in container terminals, and the implementation of Internet of Things technology and artificial intelligence in port operations management have brought the efficiency of China’s ports to a level that ensures global competitiveness. These developments have also reduced loading and unloading times and increased the safety and sustainability of operations.

On the other hand, the Chinese government has also paid special attention to the issue of multimodal connectivity while developing ports. Modern railway and road transport networks are directly connected to ports to facilitate the rapid movement of goods to the interior of the country and beyond its borders. This integration of transport has made China’s ports not only unloading and loading centers, but also major hubs in the global supply chain network.

Overall, the performance and development of China’s maritime and port infrastructure reflects a multi-layered strategy: increasing operational capacity, upgrading management technologies, focusing on multi-modal connectivity, and playing a pivotal role in international trade. This approach has led to China’s ports being elevated from regional centers to global hubs in recent decades, consolidating China’s role in the international economic structure.

The consumption value of metals

The development of China’s maritime and port infrastructure, due to the capital-intensive and technical nature of this sector, is directly and extensively linked to the consumption of various metals and industrial raw materials. Every port project, from the construction of docks and breakwaters to container terminals and support facilities, requires huge amounts of steel, cement, aluminum and copper, which play a fundamental role in both the construction phase and the operation process.

Steel is at the forefront of these materials. The construction of huge docks, gantry cranes, load-bearing structures and even energy storage systems and tanks require steel with grades resistant to marine corrosion. Steel consumption in this area has not only put pressure on domestic demand, but has also led to the development of production lines for special high-strength steels.

Chart 2. Investments in China’s maritime infrastructure development

Chart 2. Investments in China’s maritime infrastructure development

Aluminum also has a prominent share in this sector. Due to its lightweight and resistance to corrosion, aluminum is widely used in the construction of superstructures of port equipment, access bridges, as well as the hulls of service boats. The growth in demand for aluminum in maritime infrastructure has increased along with the expansion of modern terminals and advanced logistics equipment.

Copper plays a key role, especially in the field of electrical and telecommunications systems. The development of modern ports requires large power supply networks, lighting systems, intelligent control systems and communication technologies, all of which require the consumption of large amounts of copper. In addition, the use of new technologies such as the Internet of Things and artificial intelligence in port management has doubled the importance of extensive cabling and copper-based electronic equipment.

Estimates show that the consumption value of steel in this sector was $463 million in 2003, and with the expansion of port projects and the development of shipping lines, it increased to $3.8 billion by 2023. Given current trends, steel consumption in China’s maritime infrastructure is expected to remain at $4 billion levels until 2030, indicating the enduring role of this metal in ensuring the strength, durability and safety of maritime facilities.

Chart 3. Consumption value of metals in China’s maritime infrastructure development

Chart 3. Consumption value of metals in China’s maritime infrastructure development

Aluminum, as a lightweight metal that is resistant to the humid and corrosive weather conditions of marine environments, has also gained a growing share in this industry. The consumption value of aluminum in China’s marine infrastructure increased from $74.7 million in 2003 to $664.2 million in 2023, driven by its growing use in manufacturing corrosion-resistant equipment. Based on forecasted trends, the consumption value of aluminum in this sector will reach $775 million by 2030. This trend not only demonstrates the special share of aluminum in increasing the durability of marine equipment, but also indicates China’s sustainable approach to using efficient materials to increase the productivity of port and marine infrastructure.

Copper also plays a prominent role in the development of marine infrastructure due to its high electrical conductivity and resistance to harsh environmental conditions. The consumption value of copper in this area was equivalent to $26.9 million in 2003 and increased significantly to $745.6 million in 2023. Forecasts indicate that this upward trend will continue and copper consumption in this industry will reach $957 billion by 2030.

This shows that, along with steel and aluminum, copper is also considered a vital element in ensuring the performance of electrical equipment, communication networks, and maritime safety systems, and will play a decisive role in strengthening the efficiency and sustainability of China’s maritime infrastructure.